Blog

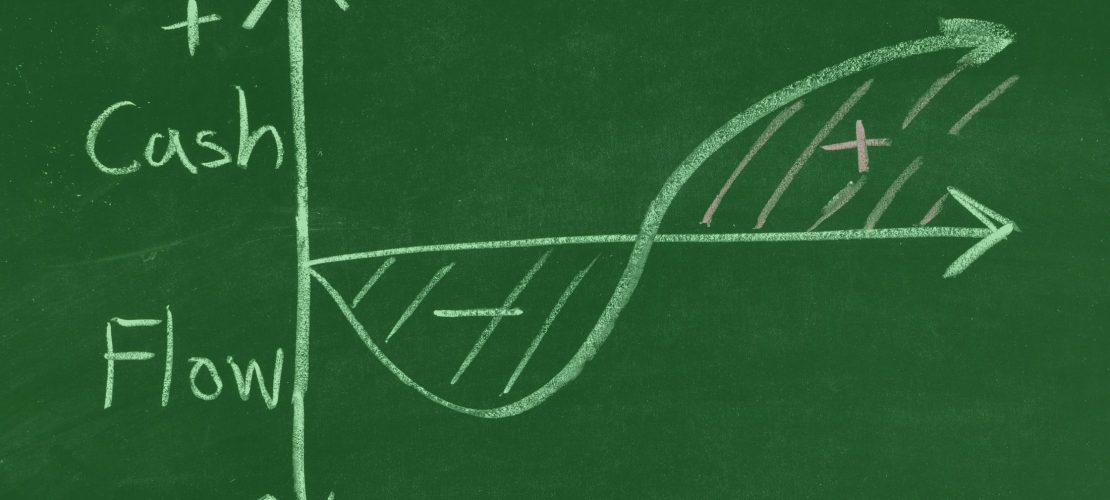

Successfully managing a business demands a delicate equilibrium of multiple factors, with cash flow as the cornerstone. Cash flow is the movement of money in and out of your business, and it serves as the lifeblood that keeps your operations running smoothly. Unfortunately, poor cash flow can have a far-reaching impact on your business, affecting everything from day-to-day operations to long-term growth prospects. Let's look at five ways poor cash flow can hinder your business [...]

Blog

As a business owner in South Africa, you are well aware of the challenges and risks that come with running a company. From economic fluctuations to unpredictable market trends, you constantly strive to secure your business's stability and growth. While much attention is often given to managing your own credit score, it is equally crucial to consider the creditworthiness of your suppliers. Delinquent suppliers can pose significant threats to your business, affecting your cash flow, [...]

Blog

As a business owner, you know that managing your finances and mitigating risks is crucial for the success and growth of your company. One aspect that can significantly impact your business's financial health is the creditworthiness of your debtors. Gaining an understanding of your debtors' credit scores can offer valuable insight, enabling you to make informed decisions, safeguard your business from potential losses, and cultivate mutually beneficial relationships. Let's explore why knowing your debtors' credit [...]

Blog

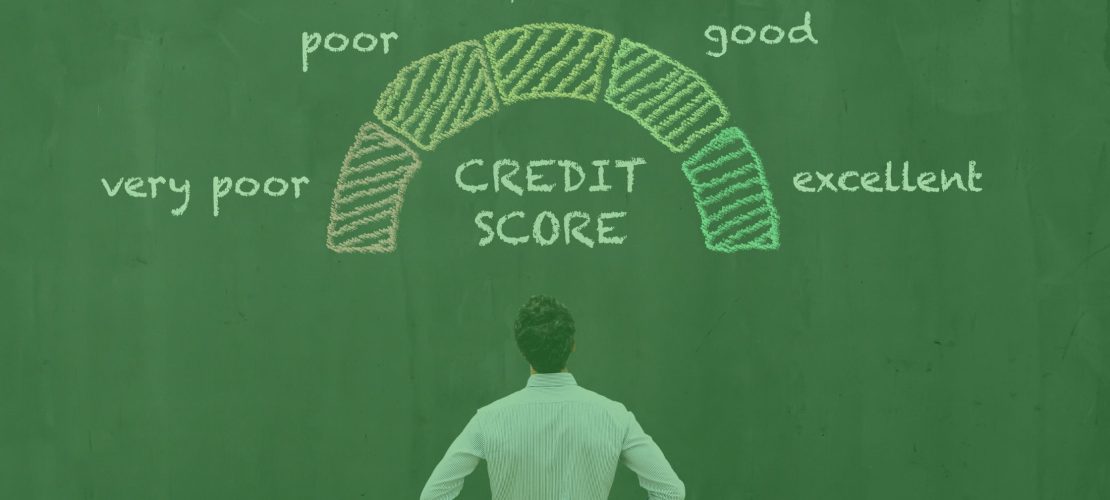

As a business owner, you may already be familiar with the concept of a credit score. In much the same way as your personal credit score reflects your creditworthiness as an individual, your business credit score provides an indication of how creditworthy your company is. In South Africa, business credit scores are used by lenders, suppliers, and other business partners to assess the financial health and reliability of your business. Let’s dig a little bit [...]

Blog

As a business owner or employer in South Africa, the onus is on you to be aware of the importance of complying with the Protection of Personal Information Act (POPIA). The POPI Act aims to protect South African citizens' privacy and personal information, making it crucial that your credit application form is POPIA-compliant. In this article, we will delve deeper into why having a POPIA-compliant credit application form is vital for your business's success and [...]

Blog

When it comes to running a business, maintaining a good credit score is essential. A company's credit score not only affects its ability to secure funding but also impacts its reputation and future prospects. But with so many credit bureaus and scoring models available, which company credit score is the best? There is a full list of active credit bureaus in South Africa, with each of them collecting and evaluating data on businesses' credit history [...]

Blog

In South Africa, the debt recovery process for businesses relies on both the sum and the character of the outstanding debts. The National Credit Advisor (NCA) provides information on the National Credit Act (NCA) and the National Credit Regulator (NCR) and has very strict guidelines in terms of how businesses can recover their debts, with specific steps that need to be taken in a specific order. We’re looking at these business debt recovery procedures below: [...]

Blog

South Africa was, generally speaking, already navigating through a torrid economic environment before the COVID-19 outbreak was declared a global pandemic. The “Corona crisis” has just been made whole lot more interesting when coupled with the fact that South Africa has been downgraded by all remaining ratings agencies to junk status when you add these elements to the fact that we were already battling electricity generation problems and the fact that when we went into [...]

Blog

It is said that when we look at things in different way that we can change our entire perception, and yes, they are right. Take for instance, if we simply accept uncertainty it then becomes an adventure and no longer uncertainty. Accepting the good in others suddenly changes envy to inspiration. In the same way as accepting what is beyond our control changes anger to tolerance. So why not look at credit limits and management [...]