Blog

In today's volatile economic landscape, businesses face an ever-present challenge: managing credit risk. This isn't just about avoiding bad debts; it's about building a resilient financial foundation to weather storms and seize opportunities. Credit risk management is the cornerstone of this resilience, enabling companies to make informed decisions, protect their cash flow, and foster sustainable growth. Understanding the Importance of Resilience in Credit Risk Strategy Resilience in credit risk strategy creates a financial foundation that [...]

Blog

As a business owner or manager, dealing with outstanding debts is an unfortunate but unavoidable part of operations. However, it's crucial to approach debt collection compliantly to protect your rights, maintain ethical practices, and nurture valuable customer relationships. In this blog, we'll explore the step-by-step process of legal debt collection in South Africa, shedding light on the legal framework, best practices, and debtors' and creditors' rights and responsibilities. Understanding the Legal Landscape In South Africa, [...]

Blog

What is a Credit Management System? In the fast-paced business world, managing credit can be daunting. A credit management system is a comprehensive solution designed to streamline the entire credit cycle, from application to collection. It's a powerful tool that empowers you to make informed decisions, mitigate risks, and optimise cash flow – ultimately boosting profitability and growth. The Core Components At its core, a credit management system comprises several interconnected modules that work in [...]

Blog

As a business owner, there's nothing more frustrating than a vendor or customer who fails to pay what they owe. Unpaid fees or invoices can significantly strain your cash flow and disrupt your operations. When this happens, acting quickly and following the proper legal procedures to recover the outstanding debt is crucial. One of the first steps in the debt collection process is sending a Section 129 Letter, also known as a Letter of Demand. [...]

Blog

Debt collection can be a complex and sometimes daunting process, especially if you're a small or medium enterprise. One crucial aspect of debt recovery is pre-legal collections. But what exactly are pre-legal collections, and how do they function within the South African context? Pre-legal collections refer to the initial stages of debt recovery, where you attempt to collect unpaid debts through non-legal means. This phase typically involves interaction between your business and debtors to facilitate [...]

Blog

If there's one thing a business owner should prioritise, it's doing a thorough credit check before signing on the dotted line with vendors and suppliers. The stability and reliability of your supply chain hinge on the financial health of those you partner with. Credit checks play a pivotal role in vendor and supplier management, offering a strategic advantage in navigating the complexities of business relationships. Mitigating Financial Risks While risks are inherent in the business [...]

Blog

Business owners know that it takes many cogs to ensure a well-oiled enterprise. Finding ways to improve your cash flow maintains fiscal health, which is the engine that makes it all go around. Cash flow is a vital part of financial health and sustained business growth. As you’re getting all your ducks in a row for a successful business year ahead, let’s explore actionable strategies to improve your business’s cash flow in 2024. Embrace Digital [...]

Blog

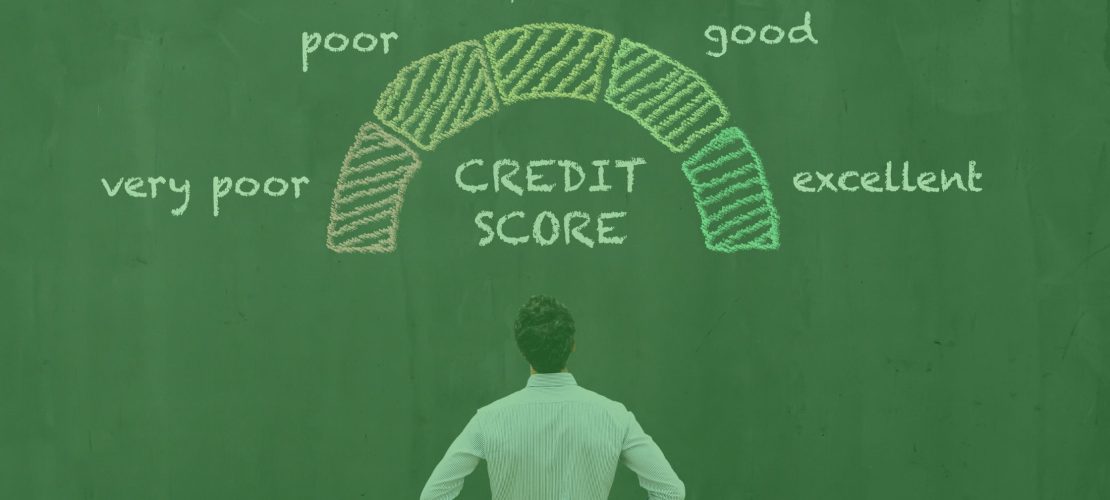

Maintaining a healthy company credit score is essential for the growth and sustainability of your company. A strong credit profile opens doors to financing options and builds trust among suppliers and partners. If you're looking for some practical advice to improve your company's credit score, you've come to the right place. Implementing strategies to improve your business credit can significantly impact your success. Let's have a quick overview of a business credit score before diving [...]

Blog

Credit is a bedrock of modern businesses. It stimulates the economy and promotes commercial activity. However, there's a potential downside. Credit allows people and businesses to spend money they don't have. It's not a perfect system, and it can entice people to spend more than they earn, use credit for ordinary purchases, and choose credit even when they have cash available. The reality is that poor credit and money management skills often lead people into [...]

Blog

In this DUNS number guide, we delve into the dynamic landscape of South African business, entrepreneurs and business owners are constantly seeking ways to gain a competitive edge and unlock growth opportunities. Meeting market demands or strategically generating a need is pivotal in achieving business success. But in the global business world, success often hinges on more than products and service offerings. It revolves around credibility. Suppliers and customers both benefit from a system that [...]