- Login

Login

Welcome back

Let's make today a great day!

Don't Have An Account Yet? Signup for free! - Who we are

- What we do

- Customer stories

- Contact us

- Login

- Sign up

- Enquire Now

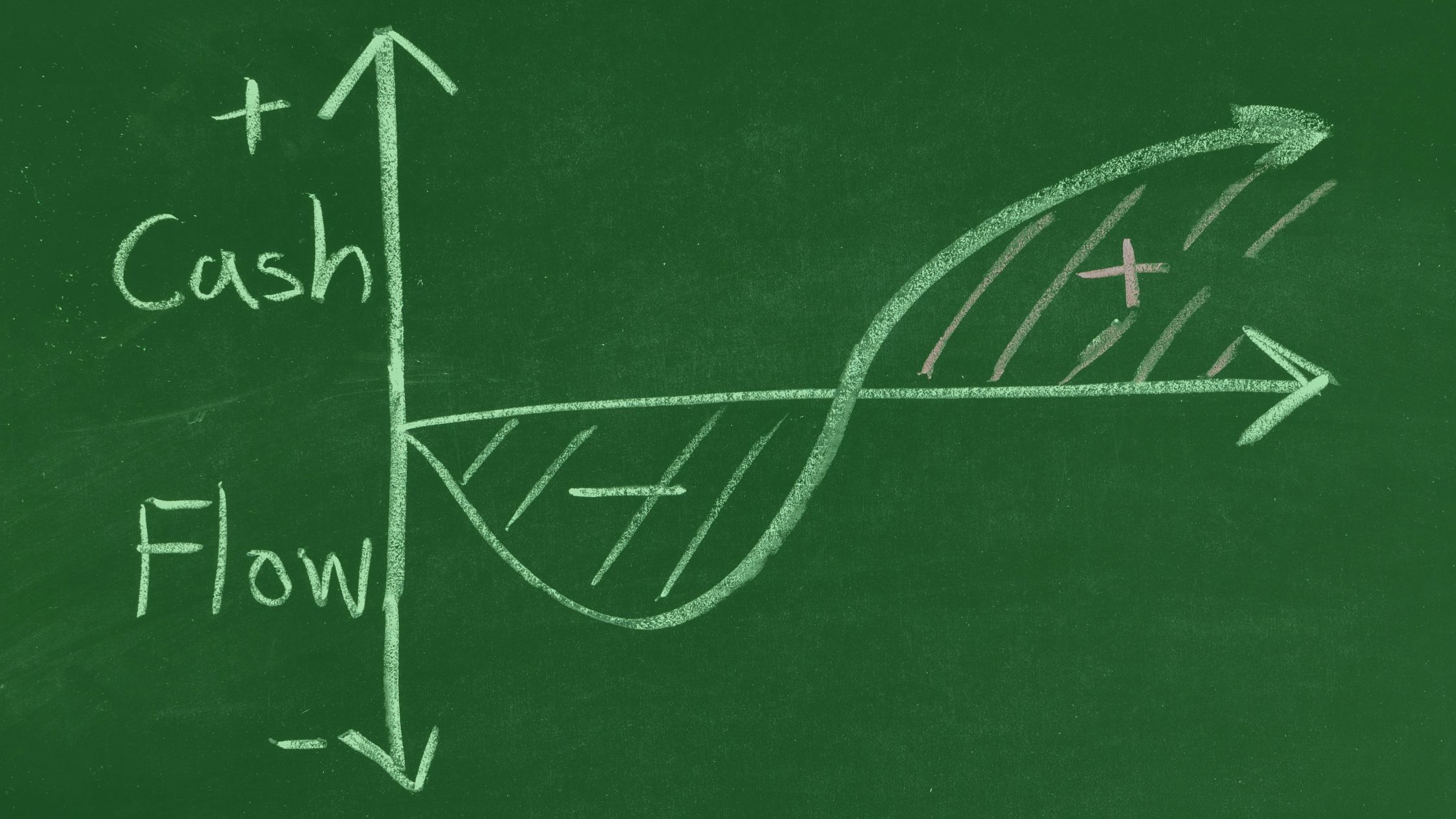

Business owners know that it takes many cogs to ensure a well-oiled enterprise. Finding ways to improve your cash flow maintains fiscal health, which is the engine that makes it all go around. Cash flow is a vital part of financial health and sustained business growth. As you’re getting all your ducks in a row for a successful business year ahead, let’s explore actionable strategies to improve your business’s cash flow in 2024.

The financial world is evolving, and South Africa is no exception. Embracing digital payment solutions can streamline transactions, reduce processing times, and increase cash flow. Encourage your clients and customers to use digital payment methods and consider implementing automated invoicing systems to expedite the payment cycle.

Building solid relationships with suppliers is essential, but so is negotiating terms that align with your objectives. In 2024, consider renegotiating payment terms with suppliers to ensure they are conducive to your business’s financial health. Negotiating longer payment terms or securing early payment discounts can provide the flexibility you need to manage your business cash flow effectively.

Excess inventory ties up capital and hampers cash flow. Conduct a thorough analysis of your inventory turnover and identify slow-moving items. Implementing just-in-time inventory management practices can optimise stock levels, ensuring you have what you need without unnecessary excess. This practice will free up working capital for other critical areas of your business.

In the digital age, data is a powerful tool for informed decision-making. Invest in robust analytics tools that can provide insights into your business’s financial performance. Analysing customer behaviour, market trends, and financial metrics can empower you to make strategic decisions that positively impact your cash flow.

Traditional financing may not always be the most agile solution. Why not explore alternative funding options such as peer-to-peer lending, crowdfunding, or invoice financing? These avenues can provide quick injections of capital, address short-term cash flow management challenges, and support your business’s growth initiatives.

Acquiring new customers is undoubtedly crucial, but retaining existing ones can be equally, if not more, valuable. Loyal customers contribute to steady revenue streams, reducing the impact of fluctuations on your business cash flow. Implement customer loyalty programs, offer personalised services, and actively seek feedback to strengthen your relationships with your clients. Satisfied customers are more likely to make repeat purchases and recommend your business to others, contributing to the stability of your cash flow over the long term.

The business landscape is dynamic, and what works today might need adjustment tomorrow. Regularly monitor your cash flow statements, financial forecasts, and key performance indicators. Set aside time for strategic reviews to identify potential challenges and opportunities. Being proactive allows you to make timely adjustments to your business strategy, ensuring a resilient and adaptable business cash flow model.

Navigating the intricacies of cash flow management requires a combination of strategic planning, embracing technology, and fostering strong relationships. As we venture into 2024, Cred-it-data wants to help you make your business thrive! We’re a trusted credit bureau in South Africa offering comprehensive credit information and solutions to assist companies like yours.

Cred-it-data offers the tools to assess the financial stability of your business partners, helping you identify potential risks before they impact your operations. Access to accurate and up-to-date credit scores allows you to negotiate better terms, establish mutually beneficial relationships, and reduce the likelihood of being caught off guard by financial challenges.

We also provide credit reports that give you a clear picture of a supplier’s financial health, payment patterns, and credit score, enabling you to make informed decisions and minimise risks. Contact us today to discover ways to improve business cash flow by leveraging our expertise. We proactively protect your business from the consequences of delinquent suppliers and unreliable clients.

How Can I Improve My Company’s Credit Score?

journey into the known