- Login

Login

Welcome back

Let's make today a great day!

Don't Have An Account Yet? Signup for free! - Who we are

- What we do

- Customer stories

- Contact us

- Login

- Sign up

- Enquire Now

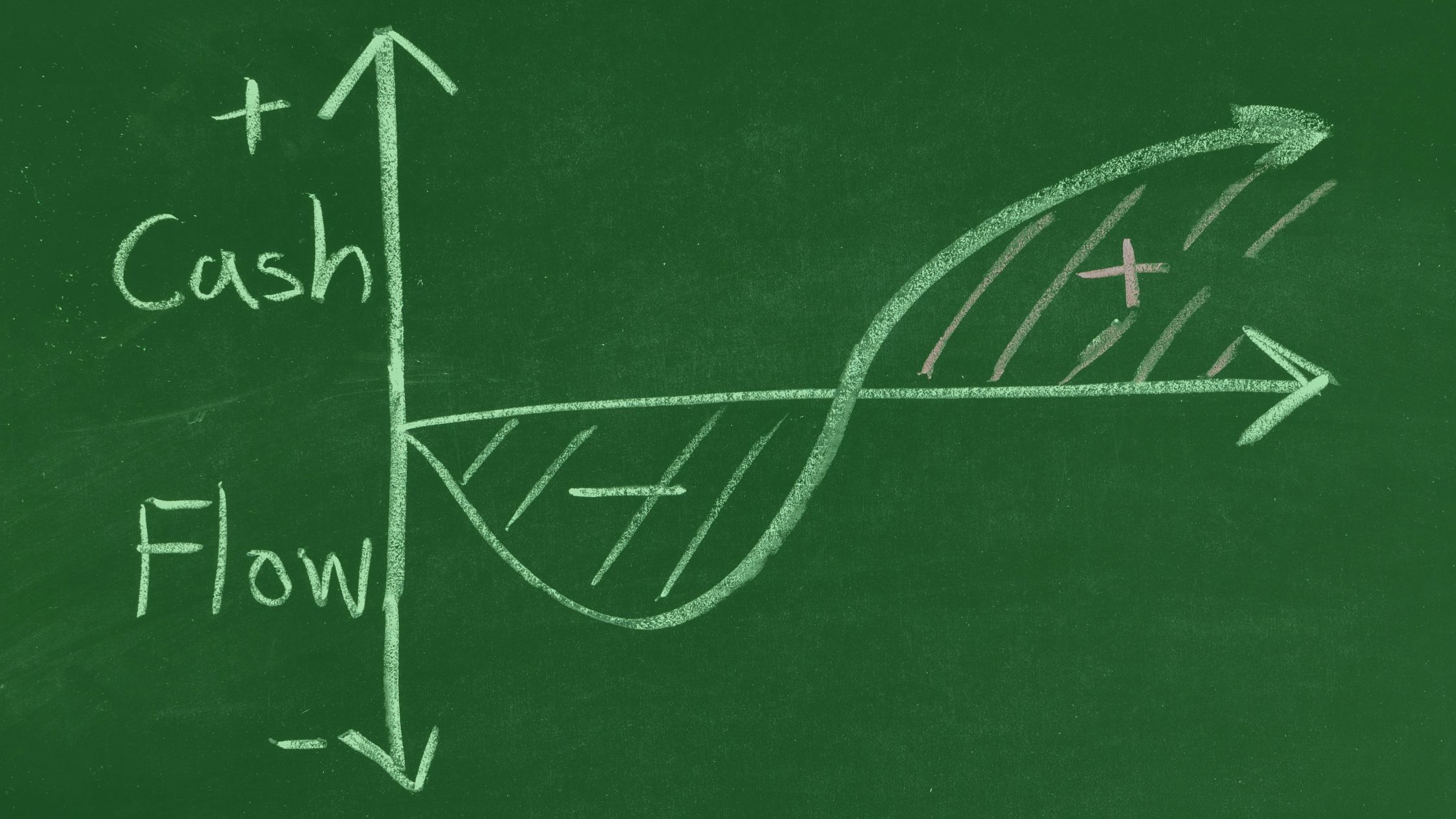

Successfully managing a business demands a delicate equilibrium of multiple factors, with cash flow as the cornerstone. Cash flow is the movement of money in and out of your business, and it serves as the lifeblood that keeps your operations running smoothly. Unfortunately, poor cash flow can have a far-reaching impact on your business, affecting everything from day-to-day operations to long-term growth prospects. Let’s look at five ways poor cash flow can hinder your business and how Cred-it-data can help you navigate these challenges.

Adequate cash flow is crucial for driving growth and fostering innovation within your business. When funds are scarce, it may impede your capacity to invest in research and development, broaden your range of products or services, or recruit fresh talent. This stagnation can hinder your agility in responding to industry shifts and evolving customer needs. To ensure competitiveness and flexibility, a consistent cash flow is indispensable.

We’re living in a time of constant change, and prospects often arise unexpectedly. Whether it’s a chance to acquire new inventory at a discounted rate or a potential partnership that could open new markets, poor cash on hand can prevent you from taking advantage of opportunities. While your competitors forge ahead, your business gets left behind, struggling to catch up due to missed chances.

Maintaining healthy relationships with suppliers is vital for the smooth operation of your business. Poor cash flow may force you to delay payments or even default on your financial commitments. This situation can strain relationships, tarnish your reputation, and erode supplier trust. The result can potentially limit your access to essential resources and materials.

As cash flow tightens, business owners often resort to borrowing money to bridge the gap. However, relying too heavily on credit lines or loans can lead to higher borrowing costs and interest payments, eating into your profits. Moreover, mounting debt can create a cycle of financial strain, making it even more challenging to achieve positive cash flow in the future.

Your workforce is integral to the prosperity of your business. Constricted cash on hand can influence your capacity to offer competitive salaries, timely raises, and appealing benefits. When employees become discontent, turnover rates rise. Once people start resigning – and the business battles to recruit new employees – current personnel get unsettled. Not only do their engagement levels drop, but they may also keep an eye open for other employment positions.

In this case, prevention is always better than cure. It’s crucial to have a comprehensive understanding of the financial health of your business and the entities you collaborate with. This is where Cred-it-data comes into play: we offer valuable insights into the credit scores of potential suppliers and clients.

Cred-it-data provides you with the tools to assess the financial stability of your business partners, helping you identify potential risks before they impact your operations. Access to accurate and up-to-date credit scores allows you to negotiate better terms, establish mutually beneficial relationships, and reduce the likelihood of being caught off guard by financial challenges.

The importance of maintaining a healthy cash flow cannot be overstated. Poor cash flow can have a domino effect on various aspects of your business, inhibiting growth, limiting opportunities, and straining relationships. By partnering with Cred-it-data, you gain the upper hand in safeguarding your cash flow, ensuring that your business remains resilient, adaptive, and poised for success. Don’t let poor finance management hinder your business progress – take proactive steps today to secure a thriving enterprise. Contact us today and leverage our expertise to make informed decisions that protect your cash flow.

Can Your Business Survive Delinquent Suppliers?

How Does Knowing Your Debtors’ Credit Score Help Your Business?

journey into the known